Adobe is for builders - Figma, and the race with Canva to attack a $100B+ market

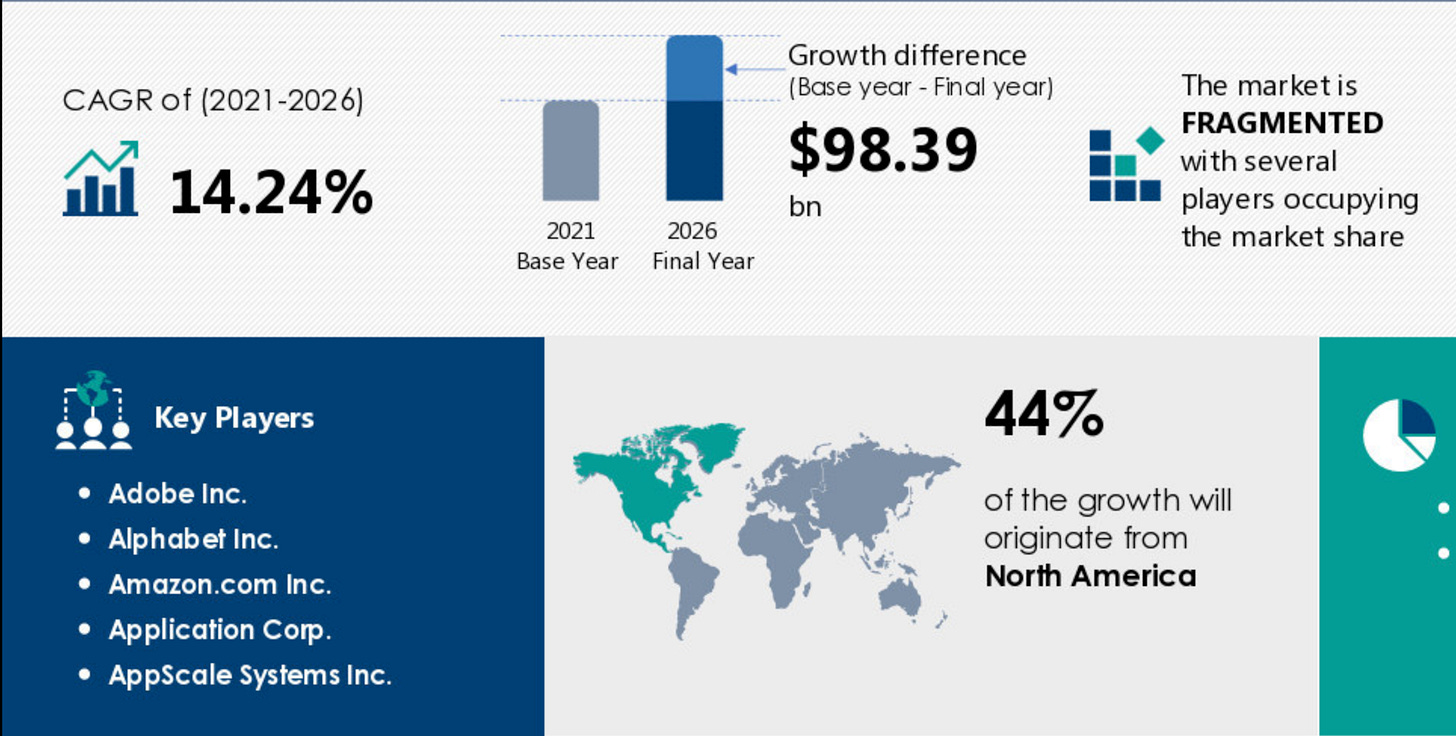

How big can it be?

From the Adobe FY21 10-K

Founded in 1982, Adobe is one of the largest and most diversified software companies in the world. We offer a line of products and services used by creative professionals, including photographers, video editors, graphic and experience designers and game developers; communicators, including content creators, students, marketers and knowledge workers; businesses of all sizes; and consumers for creating, managing, delivering, measuring, optimizing, engaging and transacting with compelling content and experiences across personal computers, smartphones, other electronic devices and digital media formats.

Now that diversified company includes Figma, at the cost of 20% of Adobe’s market capitalization. Everyone’s already written about why a 50x multiple feels rich. On a purely revenue basis, Adobe is valuing Figma’s revenue at 44x times the valuation of their own $17.6B book of business.1

So why is this a $20B product and Figma worth 50x its $400M in revenues?

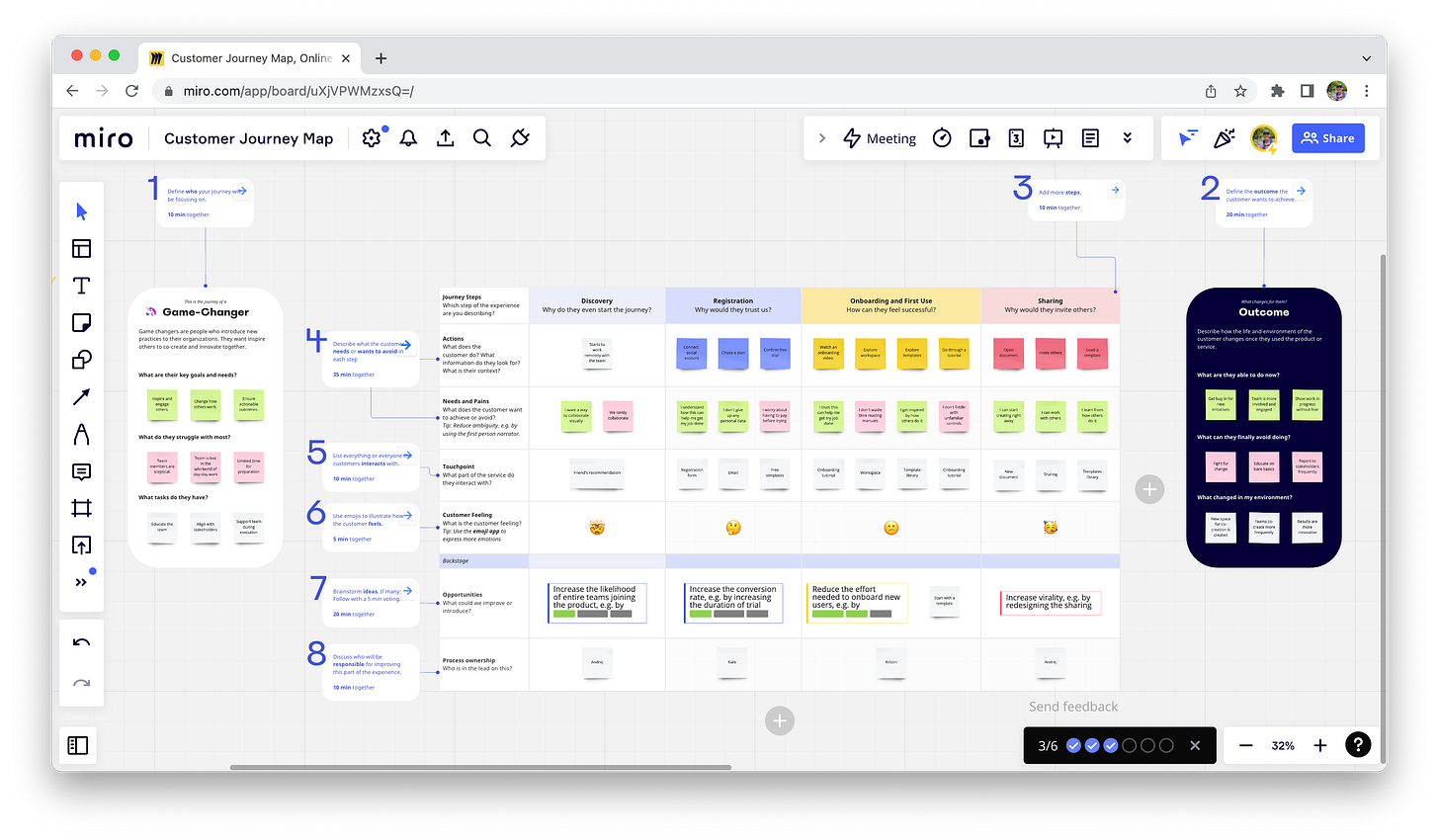

And how is it differentiated from competitors like Miro with similar U/X capabilities and templates?

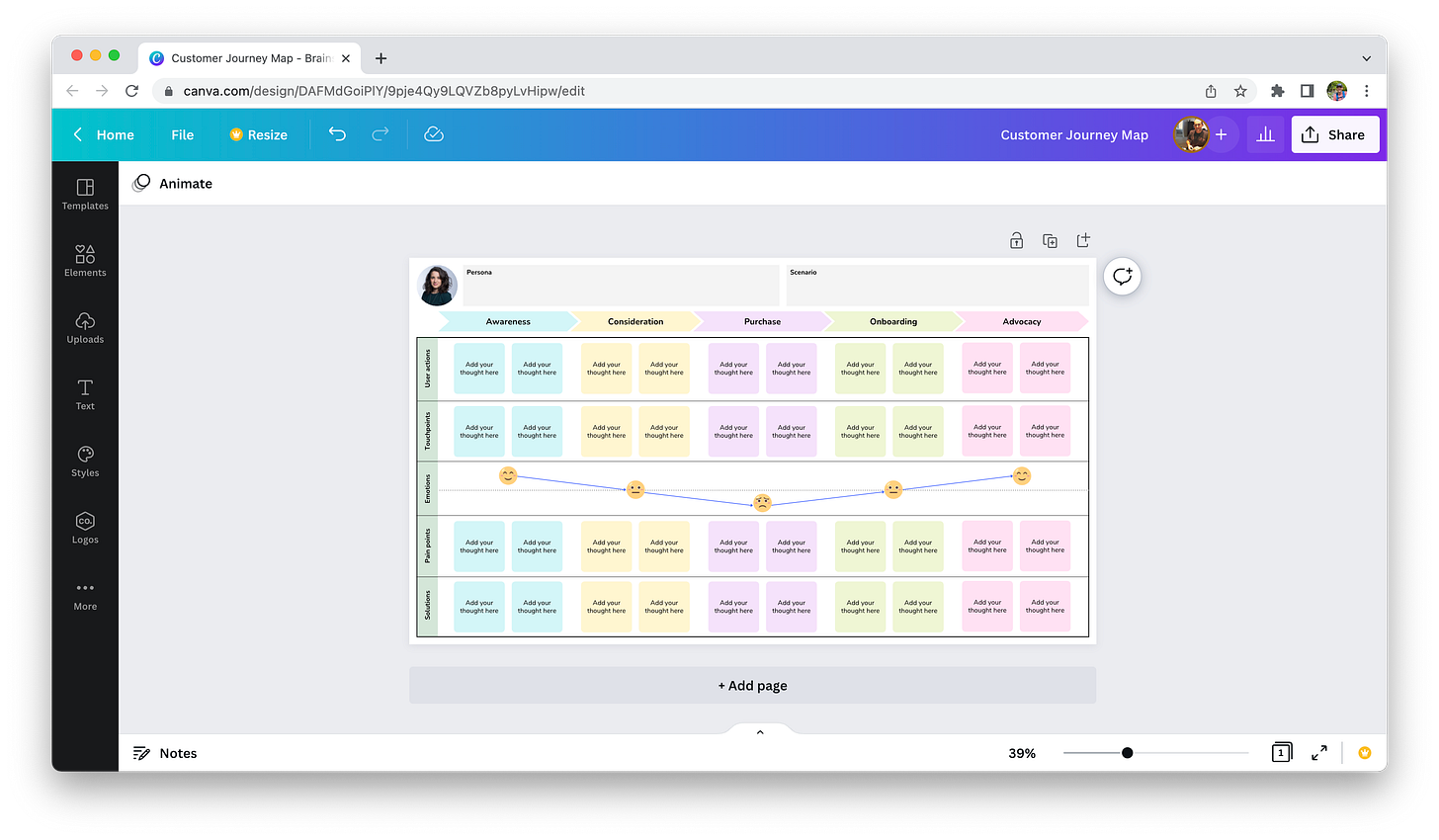

Or from what’s already there and coming soon from Adobe’s biggest competitor, Canva?

In the workplace productivity space, it’s bust times in the public markets, but don’t let that fool you. It's a $100B opportunity, and all the major players are involved.2 There’s been a lot of attention paid to the shift to remote work (news flash! lots of people will continue to work from home) and this is a rapidly growing market.

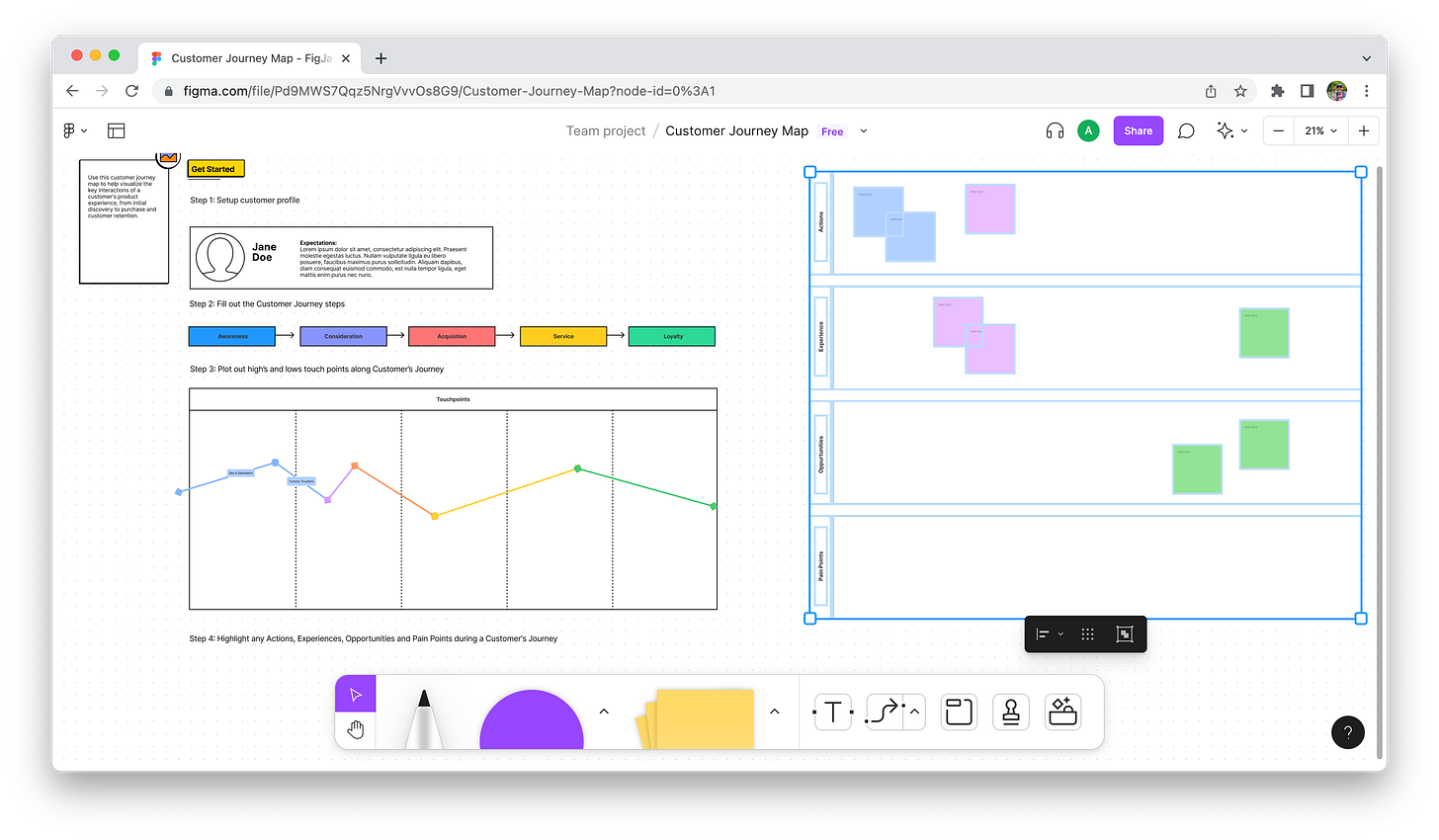

From a product perspective, the bet for Adobe is that we’re still in the early days of the market for browser-based visual collaboration. These tools are definitely next level when compared to the physical whiteboard, markers and sticky notes. They offer no-code, simple tools for strategy and functional collaboration (someday I’ll go through my phone and delete all those DON’T ERASE crappy whiteboard drawings). The result of a collaborative session is immediately documented for the team, easily referenced and living on for asynchronous collaboration. And now we get multiple “at bats” in brainstorming and creation vs an in-person session; we keep working after the meeting to improve the final result. It’s table stakes to include templates that open up an ability to visually communicate to non-artists and designers.

Let’s let Adobe’s Chief Product Officer tell us in his own words:

There are a lot of benefits, you know, I would put them into three categories. The first is really around connecting asset creation, which all of our products do across the video animation, imaging, photography, audio, etc, with the process of building interactive product experiences, which is one that is very unique and needs to be web based and multiplayer in terms of how developers and designers and other stakeholders work together today. And so we see all of the asset creation capabilities of Creative Cloud, we see what Figma is doing. I mean, 30% plus of its users are actually developers, we don’t have a product, really, that has a material number of developers using it. And so to take this vertically integrated stack of product design and development, and think about how asset creation should connect to unlock value for customers that are working together to create these digital experiences that drove a lot of the synergies and whether it’s, you know, connecting technology from Photoshop and Illustrator to some of these video editing capabilities, bring them natively into the Figma interface. There’s all kinds of ideas that our team wants to explore together, I would say the second one is around this incredible multiplayer web native platform that Figma brings into the family. That is something that they’ve built over the last 10 years. It’s unlike anything we have or could easily build at Adobe. And it’s something that we want to build a lot of capabilities on top of, for the next generation of customers that really want a web player, you know, web, native and a multiplayer experience for all of their creative purposes. And then the third is around integrating whiteboarding and presentation capabilities into Adobe Express and Acrobat. These are two products that reach millions and millions of communicators around the world who want to be able to use them to work together and collaborate. Right now there are a bunch of other companies like the Microsoft’s and Google’s and Miros, and Murals and Boxes of the world. But we think we can bring more creativity into these by whiteboarding and presentation experiences. That’s what’s going to distinguish people into the future in their labor, you know, it’s not just being more productive, it’s being more creative and telling a better and more compelling story to your colleagues and to customers, presentations and whiteboarding needs to go up a level in terms of creativity, and we can bring that by bringing these technologies together.

To summarize, its:

get developers as customers; make Adobe core tooling for all software builders

get Adobe fully into the cloud; collaboration will drive product-led growth

enter the digital whiteboarding space; be part of the future of remote work

And on that last bullet, the future of remote work and the tools that will power it…Canva had some news recently! Coincidence? I think not. Canva launched Docs, Websites, Whiteboard, Data. Docs + Whiteboard clearly go head to head with Figma (now Adobe) and probably Google Slides and Powerpoint for visual presentation design. The strategy for the data product is unclear but if we think low code/no code data and dashboards, think Airtable or Metabase. Websites competes with Squarespace, Wix, Webflow, Wordpress (and HubSpot is not mentioned enough in this market). I like the strategy; I think generally most B2B buyers want to consolidate platforms. These tools are important to remove the inefficiency costs of graphic and visual design; we need accessible tools for non-designers to replace the physical whiteboard and to create visuals for external audiences (which is Canva's core business already).

Canva reached a peak valuation of $40B against a revenue forecast of $1B before the market turned at the beginning of the year. Figma’s revenue is only 40% of that but Adobe valued their revenue 50x, even more highly than Canva’s. This in an environment where Canva’s valuation has already been written down a third from that valuation event.

These are horizontal products, which can be used in many use cases across many markets. And in those markets, in the long run, Canva and Adobe are increasingly head to head with Microsoft, Google, Amazon and Salesforce. That can go really badly from a growth and valuation perspective, i.e. Slack as Microsoft bundled Teams for free. Such is the value to the enterprise of deep integration and consolidating platforms.

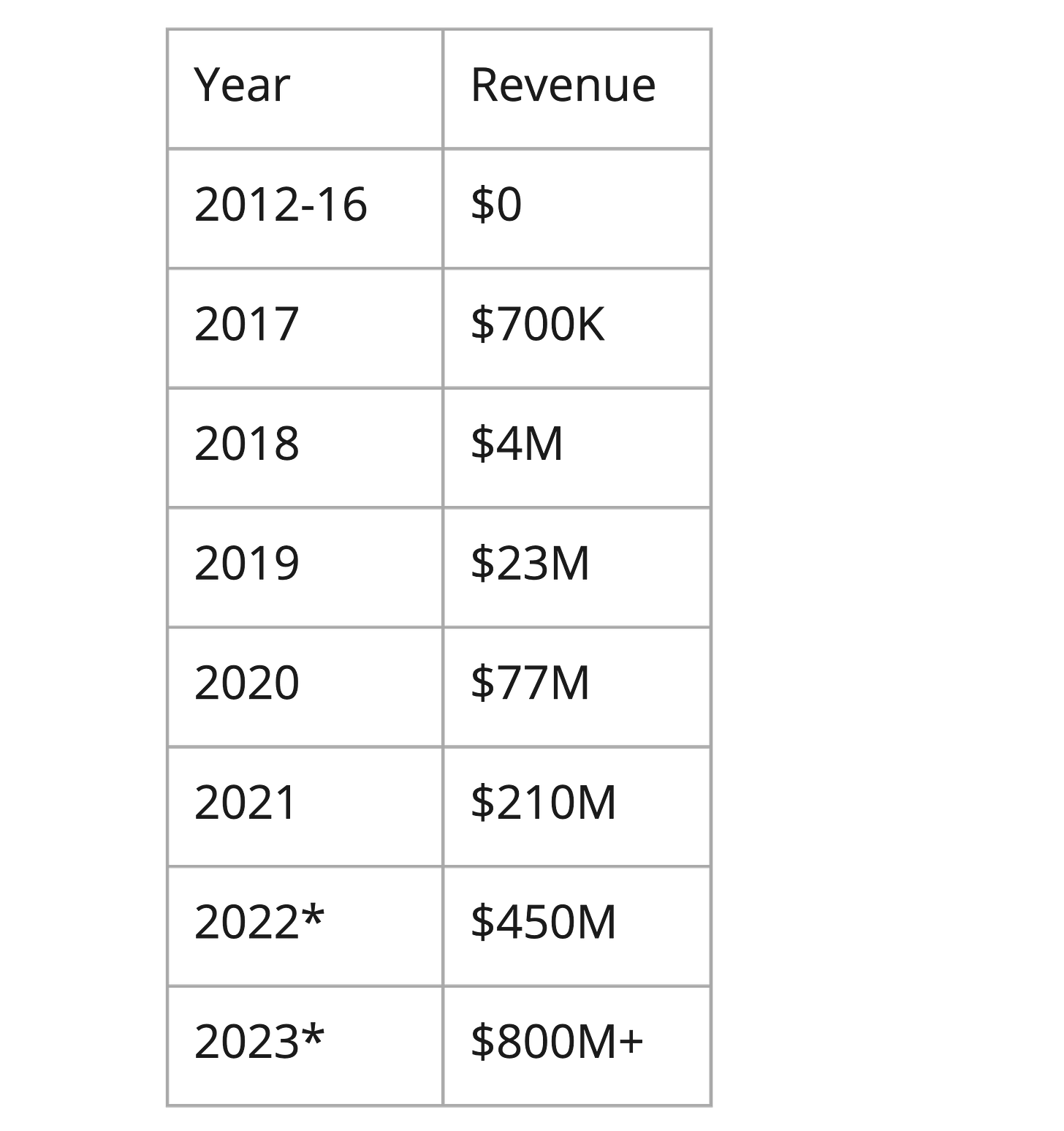

And that unlocks the key to this deal for Adobe, Figma’s incredible growth rate as well as the latent value in Figma’s current revenue base. Put this growth trajectory alongside alongside the upsell potential into Adobe’s 26 million users, and Adobe can target $1B+ in 2023.

Figma’s an amazing story in product-led growth, and a lesson in the time it takes to build a differentiated product in a complicated space. Taking the time to build a user base with a free version of your product feeds your product development with growth and real user data; at the same time you’re building pipeline for future upsell and understanding your monetization levers to launch premium plans. Today Adobe earns $600+/year from each paid user. Figma is at $100/user/year, and 15% of the users (4 million). Right away Adobe has a $2.2B TAM, just in its own customer base, to layer into Figma’s growth. And within that TAM, sales and marketing costs come way down, and you’ll generate major additive free cash flow.

In selling into their base Adobe does face a conflict with that product-led growth model that’s propelled Figma’s flywheel. The Adobe sales machine will immediately seek to layer Figma on within the base and with new business, and in turn that will implicitly shift Figma’s motion away from freemium, bottoms up product-led growth and toward enterprise sales. The good news is that means higher prices and ARPUs and in the long run, significant CAC savings and scaling effects to Adobe’s growth.

It all makes for an interesting template for all those freemium businesses we’re seeing today and the buzz of product-led growth. Maybe freemium isn’t a long-term strategy in B2B SaaS, but a growth tactic aligned to a finite stage of the company lifecycle. And maybe that final step is the safe cozy home of the bundle and sales-led distribution.

Based on Q3 earnings results of $4.4B

Graphic and data from PRNewswire